Fidelity Resolution Model

We understand there are many tax resolution services available.

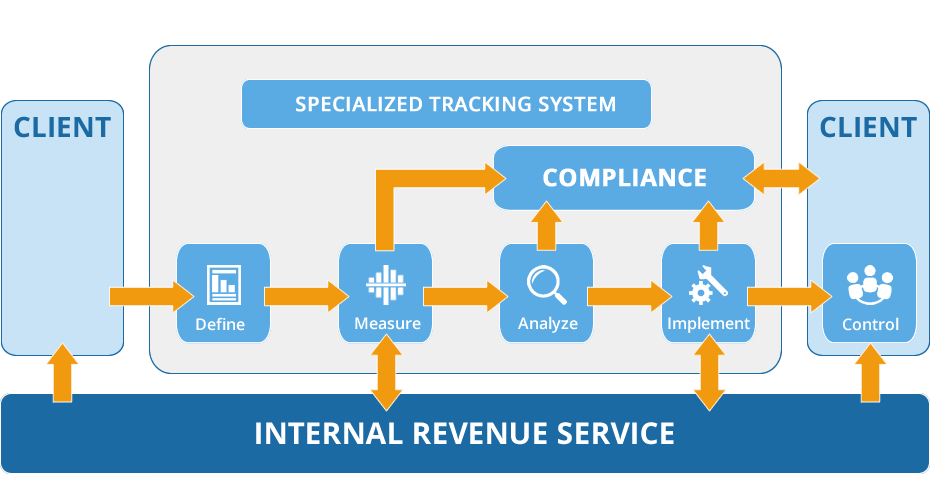

What makes Fidelity Tax Relief different is our systemic approach to operational excellence and transparency in everything we do. To that end we’ve developed the Fidelity Resolution Model (FRM), a fluid 5 step process designed to provide optimal service and operational excellence throughout the tax resolution process. It keeps the client at the center and is triggered as soon as the client contacts us, which typically occurs after the IRS has taken collection action or sent a letter. Once contact begins, every client is processed and tracked through the FRM by our Case Managers to ensure every client receives a high level of service consistent with our Mission Statement.

The Define Phase

Upon first contact with the client, the Define Phase is initiated. One of our experienced Tax Consultants discusses the situation with the client, collecting as much information as possible in order to adequately assess the situation. We also determine whether immediate action is required, such as removing a levy or wage garnishment, which can be done in 24 hours. We enter all information received from the client into our safe and secure Specialized Tracking System, which assists us in finding the best solution.

The Measure Phase

During the Measure Phase, our Tax Professionals evaluate the client’s current situation by reviewing the information collected by the client and diligently working with the IRS. This helps us determine what the IRS wants from the client so we can find the best solution.

The Analyze Phase

Once we have the information from the client and the IRS, we can analyze the data to determine the best resolution for the client that will also likely be accepted by the IRS. There are several factors involved in the process. We also formalize the approach we will take with the IRS, keeping the client informed along the way.

The Implement Phase

Once we have had the go ahead from the client, we start the Implement Phase. We develop a compelling case and present it on behalf of our client to the IRS. At Fidelity Tax Relief, we have more than 98 percent success rate in our negations with the IRS. We also handle all communication with the IRS on behalf of the client, including challenging the Agents or Officers in the event of rejection or slow response. This phase ends when we have successfully negotiated a tax relief settlement with the IRS or other tax agency.

The Control Phase

Our care for our clients does not end once we have completed their tax resolution settlement. Once the IRS problem is completely resolved, our clients enter the Control Phase. This is where we provide advice and coach our clients in avoiding similar issues in the future by remaining compliant with the IRS.

Our Operational Excellence process is rooted in our mission statement and core values. We carefully evaluate every step of the process and develop detailed plans to protect our clients from further actions by the IRS. Our team has more than 20 years of combined experience in resolving tax issues and dealing with the IRS.

If you have an outstanding debt to the IRS, one of Fidelity Tax Relief’s tax professionals can help you find the best solution for paying off your debt and once again becoming compliant.

Let Fidelity Tax Relief Help You

Call us Toll-Free at 877-372-2520

for a free, no-cost-or-obligation consultation.

for a free, no-cost-or-obligation consultation.