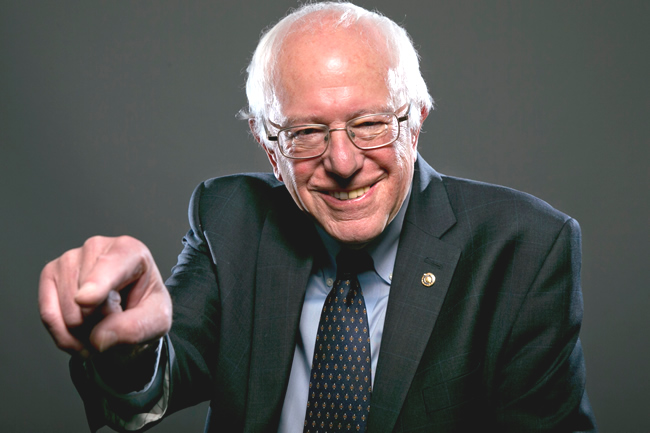

Bernie Sanders’ rise in the presidential campaign has surprised many. He currently is the most electable candidate not just in the Democratic Party but across the board. The latest polls show he would defeat Republican front-runner Donald Trump by a wider margin than Hillary Clinton. Fueling his campaign are his more socialist ideas that resonate with many, especially Millenials, that still struggle to find work as the gap between the poor and the rich widens.

Many of Senator Sanders’ ideas to rebuild the middle-class double as a possible way to fix a broken nation. However, these socialism-light policies still scare many, especially the right conservatives that make up the Republican Party. One of the largest concerns is whether or not the programs promised by the Sanders campaign will lead to higher taxes as a way to find funding.

Four Principles of Sanders’ Tax Plan

The short answer to whether or not Senator Sanders’ presidency will lead to higher taxes is yes, but only for the 1 percent. Senator Sanders has yet to propose a specific tax plan, but he has several ideas that all circle around the same four principles, according to his website:

- Implement progressive income taxes on the very rich

- Change the estate tax so that the very rich have to pay a fair amount

- Have a more fair taxation system for corporations

- Implement taxes on Wall Street speculation

Taxing the Rich

Senator Sanders has promised to raise taxes, something that all the democratic candidates plan to do to fund more programs to help struggling Americans. Sanders plans to tax the richest Americans, which are those who qualify for the top bracket for income tax. The minimum income to qualify for this bracket is $400,000 per year. Although rumors have stated he plans to tax this group as high as 90 percent, in reality it will not be that high. He has yet to state an exact number but has promised that it will not be as high as the 90 percent implemented by President Dwight D. Eisenhower.

He will also raise taxes on capital gains and dividends, which can help to raise capital, as it is another section that fuels the economic imbalance. The low rates on capital gains and dividends further help the top 1 percent to increase their wealth, and Senator Sanders plans to raise the tax rates to increase federal revenue. To tackle the unfairness in the estate tax, Senator Sanders plans to lower the bar on the estate taxes from $5.4 million for an individual and $11 million for a couple down to $3.5 million and $7 million respectively. Many of these programs will not affect over 99 percent of Americans and will help to equalize the tax burden of the rich and poor in the country.

Removing Loopholes Contributing to Economic Imbalance

In addition to raising income tax on these individuals, he also plans to remove tax loopholes and breaks that benefit multinational corporations and the very rich. This would help to put the financial burden of his planned social safety nets on those who can easily afford it: the extremely rich. According to Senator Sanders’ campaign, the current tax code helps create the economic imbalance. The very rich and corporations get away with more than the average individual and do not pay a fair share.

The Economic Effect of Sanders’ Tax Plan

For the average American, nothing will change in regard to their taxes, and they may even find themselves being able to pay for their tax liability with ease if Bernie Sanders is able to implement his other programs, including a higher minimum wage, free healthcare, free childcare, higher social security benefits, and free public college education. Of course, Senator Sanders cannot do any of this alone, as anything he proposes must go through Congress. What comes out as a law can look almost nothing like his initial proposals. Some new taxation may even end up hitting everyone, such as the current bill in Congress backed by Sanders that utilizes a payroll tax as a way to finance a mandate for 12 weeks of paid family and medical leave.

With the primaries a few months away and the actual inauguration of the next president over a year away, none of Senator Sanders’ tax plans will be implemented any time soon, and his proposed changes do not affect those who already have a significant tax debt. There are current programs in place that can help you to reduce or even remove your tax debt. Contact the tax professionals at Fidelity Tax Relief at 877-372-2520 today to find out how we can help you get rid of your tax debt and no longer be under the thumb of the IRS.